BACK TO CHAPTERS

Deep DiveRole of OGS in FCV contexts

Off-grid solar has the potential to play an important role in providing electricity access to conflict-affected areas, where the traditional electricity supply infrastructure is often disrupted or severely damaged.

In conflict affected areas, traditional grid infrastructure often becomes a casualty of the ensuing violence, plunging large sections of the population into darkness. Countries are also characterised by weak public utilities and limited private sector involvement to begin with and limited capacity of the government to improve this service, either due to a lack of funds or corruption. Market based solutions are limited in their impact and the private sector may not find it profitable to operate in these areas owing to higher operational costs and a diminished capacity of customers to pay. Lastly, even when the violence may subside or end, it does not immediately lead to a restoration of electricity since the infrastructure may require significant repair before it can be functional.

People living in FCV areas are therefore particularly vulnerable to losing electricity access, even if they were previously electrified, or not being reached at all. OGS can provide access to electricity in these areas and play many roles, from being a primary power source in areas where there is no power or where supply is being restored, to a vital backup system in areas with an unreliable power supply.

Below, we discuss examples from Ethiopia, the Democratic Republic of Congo, and Nigeria, and how the nature of conflict in these countries has impacted access to electricity for people.

Ethiopia

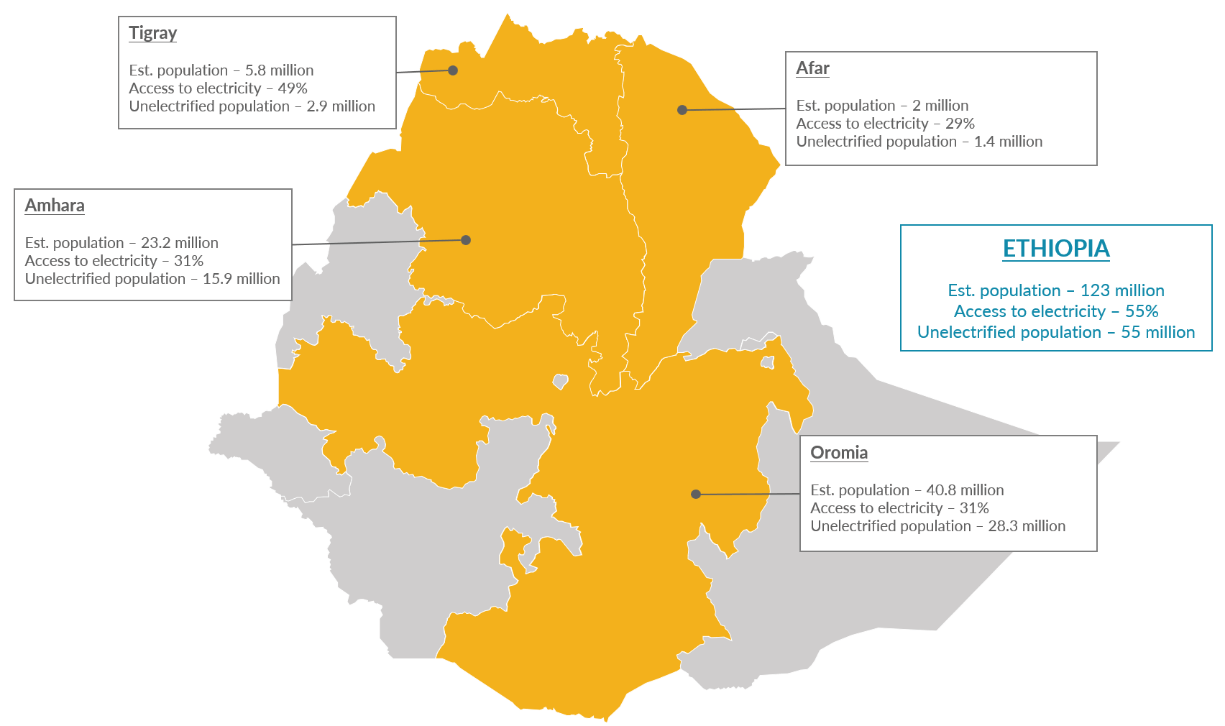

Ethiopia is home to the third-largest unelectrified population in the world, nearly 90% of whom live in the conflict-affected regions of Tigray, Oromia, Amhara, and Afar. Since late 2020, a protracted conflict between the government and armed groups in these regions has resulted in the government scaling back its development efforts to provide electricity to the country’s 55 million unelectrified people. Electricity supply, especially in the Tigray region, has also been disrupted by centralized electricity shutdowns and the inoperability of the Tekeze Dam and Ashegoda wind farm.

Electrification rates in conflict-affected areas of Ethiopia

Despite a ceasefire, attempts to re-electrify communities in these regions have been hampered by the continued financial difficulties faced by utility companies and a reduction in people’s ability to pay for power. State-run utility companies faced major financial issues before the conflict, including high input costs with limited foreign exchange; the conflict has only exacerbated these challenges. The Ethiopian Electric Utility estimated damages to the power infrastructure in conflict areas at ~USD 50 million in December 2022. Utility companies are required to make major capital expenditures while under severe financial stress, having forgone revenues for over two years and facing a foreign debt repayment challenge amid a forex crisis. As a result, state-run utility companies are preparing to cut subsidies to generate revenue needed to continue operations—leading to an expected rise in electricity bills. However, the conflict has also had a significant impact on people’s income, especially in regions that relied heavily on commercial activities like tourism, which constrains the population’s ability to afford grid electricity.

The conflict in Ethiopia highlights the need for decentralized electrification solutions like OGS to be included as part of relief packages and electrification strategies in a conflict situation. OGS allows people to continue having basic access despite being cut off from the central grid. It also serves as a pre-electrification solution for people as they recover from the economic impact of conflict.

Democratic Republic of Congo

Democratic Republic of Congo (DRC) is home to the second largest unelectrified population globally, of which approximately 46% live in conflict-affected regions, notably Nord-Kivu, Sud-Kivu, and Ituri. Recurring cycles of insecurity and conflict over the past 30 years—including escalations of tension and violence in the eastern regions since 2022—have left 6 million people internally displaced. The movement of large population groups due to the conflict makes the demand for electricity unpredictable and effective national electricity planning difficult. As a result, internally displaced groups are left without energy access.

Electrification rates in conflict-affected areas of DRC

The conflict situation and the state of DRC’s national grid have dissuaded investors from providing capital for the expansion of energy access. The ongoing conflict situation in DRC has led to long-term security, infrastructure, and business instability—factors investors typically consider unfavorable when assessing country risk. These factors, compounded by limited infrastructure to support grid strengthening and expansion (due to impacts of the ongoing conflict) and the absence of a national electrification plan to chart a clear path forward, have dissuaded investors from providing capital. In addition, the country’s focus on mining and exporting minerals may leave little public funds or capacity available for the effort to expand residential energy access—potentially further alienating electrification investors.

The conflict is unlikely to resolve in the near term. Solutions designed for conflict-affected situations—such as standalone off-grid solar solutions—present an opportunity to ensure that a large proportion of the affected population can access electricity. In the face of ongoing uncertainty and the fact that many communities are still not connected to the grid (77 million people), standalone OGS solutions offer an attractive, fit-for-purpose, and least-cost alternative. The DRC has a large US-dollar-powered commodity economy, with key enablers such as mobile money in place. The country’s urban economic hubs face chronic power problems, which translates into high average revenues per user (ARPUs) and the chance to build a sustainable solar company much faster than usual. Several OGS companies sell solar lanterns and SHS in the DRC, including Altech, BBOXX, and d.light. However, armed conflict and a lack of market assessment and data make it difficult to gauge demand, creating a significant barrier to entry, that so far has undermined the commercial viability of the market.

Nigeria

Nigeria is home to the world’s largest unelectrified population. 86 million people in Nigeria lack electricity access; approximately 54% of this population live in a few conflict-affected regions, including the North. The country has endured several crises over the last few decades, some of which are ongoing, with terrible consequences that include millions of people displaced, over 350,000 killed, and a lack of social or economic stability for most Nigerians.

Electrification rates in conflict-affected areas of Nigeria

These distinct but overlapping crises have affected Nigeria’s security and social and political infrastructure, to the detriment of efforts to increase electricity access. Many factors have led to Nigeria’s lack of reliable grid power, including insufficient funding to maintain and upgrade infrastructure and theft/ vandalization of grid equipment. Roughly 39% of Nigerians are living off the grid; a large share of the other 61% on the grid have only intermittent power—i.e., less than six hours of power per day. Overall, 80% of the population experiences inadequate energy supply. The grid is highly inefficient—only a quarter of installed capacity is actually distributed to consumers—and suffers from outages 63% more frequently than average for countries in Sub-Saharan Africa.

Ongoing conflict continues to constrain electricity access in Nigeria. Companies face challenges in entering regions with high-security risks, which further limits energy access to households in these areas. At the same time, evidence suggests a strong negative correlation between conflict exposure and household income. Very few conflict-affected households receive financial assistance, further limiting their ability to afford electricity access.

Scaling up the market for off-grid solar products can help Nigeria approach universal access to electricity more quickly; recent enablers have the potential to speed up the transition to solar power. The Rural Electrification Agency (REA) has been promoting OGS solutions through the Nigeria Electrification Project, a ~USD 550 million project to electrify 100,000 small enterprises and provide electricity access to 3.5 million people over the course of six years. At the same time, the significant spike in fuel prices, alongside broader inflation, has made energy access untenable for many whose electrification depended on diesel generators.

As large global companies expand into the market, Nigeria has already begun to see some early commercial success in the OGS sector. Nigerian off-grid solar market has been growing at a 12% CAGR since 2018. Sun King, d.light, and other global companies have established themselves in the market; their sizable earnings suggest that the demand for OGS products is high.